If you beat across the board, why does your stock fall?

For those unaccustomed to earnings season jargon, I’m referring to exceeding the expectations of Wall Street analysts for revenue and earnings and other metrics. The kicker is raising guidance – telling investors you’ll do better than everybody thought.

What does it mean then if you do all that and your stock declines?

The answer is simple. The money responsible for setting that stock’s price – say TMO – isn’t motivated by beating across the board.

So, what is it?

For twenty years at ModernIR our mantra has been understanding how the market works and what the money is doing by measuring the data. We are in the Prediction Market era. You can bet on everything, everywhere, all the time. Kalshi. Polymarket. Robinhood. Draftkings. Five-times-leveraged ETFs. Two-hundred-times-leveraged cryptocurrency futures.

Meanwhile, the money consuming consensus and research has moved inversely with prediction markets. Why research something when you’re polling the audience?

Yet research coverage of US equities has been resilient. Why the dissonance in outcomes versus expectations? Take your favorite AI engine and ask for a study of 28(e) Safe Harbor provisions for money managers.

Like a great sea of market regulation including the National Market System and 13F’s, the answer goes back to 1975 when Congress decided to overrule the free market and abolish fixed commissions for stock trades.

We used to have “Two Dollar Brokers.” Some people as old as me might remember. Under the Buttonwood Agreement of 1792 that laid the foundation for the NYSE, brokers agreed to give each other preference before looking elsewhere for trades, and to set a minimum commission that became $2.

Pretty simple. You could charge MORE. But not less. No undercutting each other on price.

As with everything emanating from a large committee like Congress, things got complicated. While doing away with minimum commissions, the legislative body – yep, you guessed it – created a bunch of exemptions.

And that’s section 28e. It permits money managers to pass on to clients the cost of things like corporate access and research if there is value derived.

Well, if the money you used to manage is leaking away to Blackrock, Vanguard and State Street at a rate of $500 billion per year, you’re going to look around for things that might generate revenue or offset costs.

Brokerages can generate higher trading commissions – somebody’s gotta execute trades for buys and sells – under 28e provisions. And money managers can assign those costs to clients rather than to internal direct costs if there’s value added.

Voila, as the French say. You get a lot of…fluff in stock-coverage and corporate access. And the money goes right on migrating to Blackrock, which gathered another $200 billion last quarter.

Because Active managers don’t beat the benchmark to justify those costs they pass on, as Morningstar yet again notes.

Back to causes for why consensus won’t tell you how your stock will do with earnings. GM exploded – which is unfortunate for GM because now Blackrock won’t buy it because it’s an outlier, and it may take two quarters to get back into the Passive basket – with earnings on a 37% jump in Fast Trading (one of the firms is in fact called Jump Trading) day over day by these firms.

TMO? Massive short bets Oct 21. The bets trump the results.

Nobody talks about market structure anymore. Nobody talks about high-speed traders. Yet they’re minting money. They’re not betting on outcomes versus expectations. They are betting on SPREADS.

GM jumped 15% yesterday. Double its volatility – but almost exactly the total volatility of the trailing five trading days, which departed dramatically from the preceding ten trading days. The change for GM occurred Oct 14 when the pattern of spreads changed.

I don’t know the ingredients in the recipe, but it’s bets. Changes in behavior. It’s got nothing to do per se with what The Street expects. The market is mathematical. Betting is mathematical – odds, probabilities.

This is the stock market we’ve got. Machines price everything. Money runs on models. Stock-pickers cannot consistently outperform those models because the market isn’t priced by fundamentals.

It’s math.

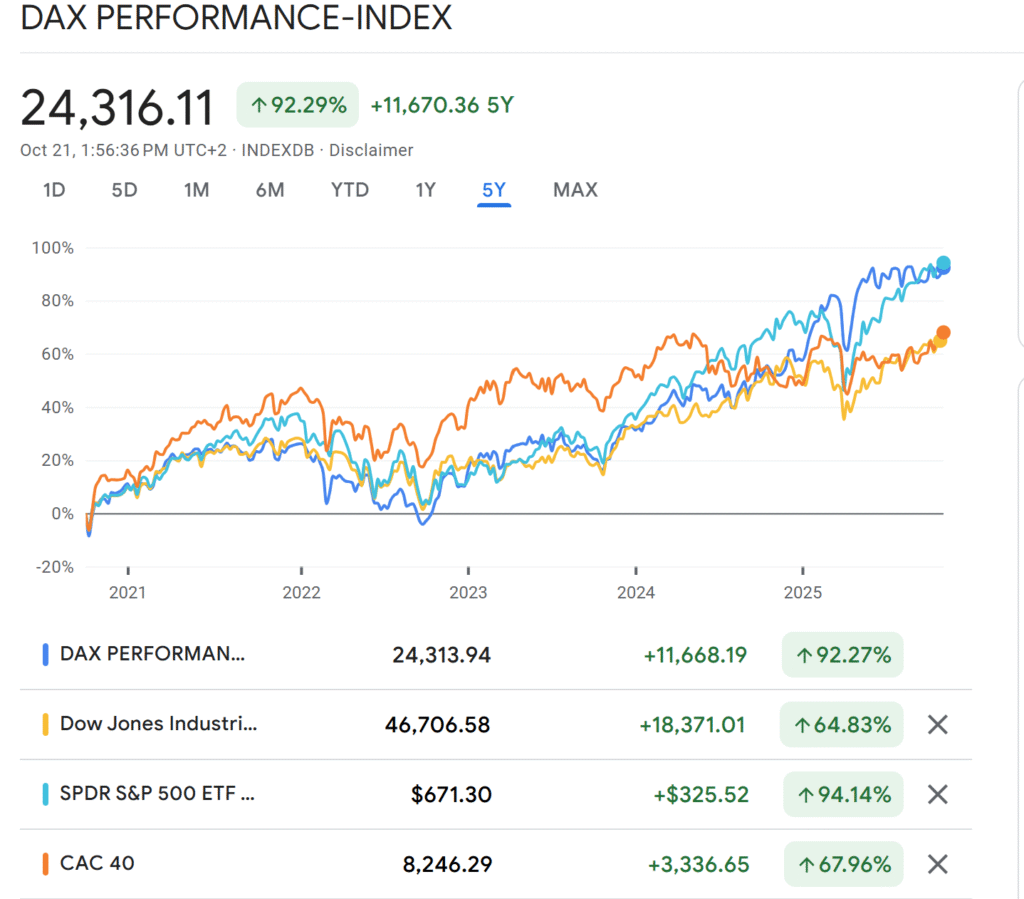

So, how do you navigate that market as an investor? Take a look at five-year charts or the German DAX, the French CAC – indexes for those international markets. Compare them to five-year charts for the Dow Jones Industrials, the S&P 500.

France and the DJIA are identical. Germany and the S&P 500 are identical. So are you investing internationally, or are you investing in currency spreads?

So investors, use math. We can help with that (we’ve now seen a shift from momentum to low volatility in our model portfolios).

Here’s my point. The market is not motivated by what people think. It’s driven by arbitrage around spreads. The behavior is pervasive because machines are pervasive.

Public companies, at some point we’ve got to catch up, get ourselves out of 1975 and into the present. Don’t report results like the Street is setting your price. It’s not. Ask us for help, public companies.