The Federal Reserve Open Market Committee meets today to agree to cut rates.

Well, that’s the expectation. It’s with inflation at 3% and if ADP is to be believed (I think payroll data are superior to a government survey, but what do I know), jobs rising.

“Quast. Before we get to that. You wrote a couple weeks ago that it’s different this time. Are you eating a barbecued crow sandwich with some Carolina vinegar barbecue sauce?”

Because stocks are up? Price is not predictive. Behavior is. No, it’s different this time, if what we mean by “this time” is “the things happening since April.” Doesn’t mean trouble. But it might. Does mean change. Stay tuned.

Back to the FOMC, the Atlanta Fed GDPNow model powered by “high-frequency data” is running at 3.9% GDP growth at Oct 27. The average GDP growth since the Pandemic is about 2.4%. That was with interest rates a lot lower than they are now.

Is any economist paying attention?

Tim, you twit. You don’t understand economics.

No? I know that since 1948, GDP growth has averaged 3.2%. The Minneapolis Federal Reserve shows that since 1948 inflation has averaged 3.5%. The Fed Funds Rate that’s about to be slashed again has averaged 4.6% since 1948. It’s currently 4.1%.

The data signal that a higher interest rate encouraging sounder thinking about taking risk is better. Slash interest rates and people gamble because saving money offers no return.

Based on what’s happening in the NBA, at Kalshi, at Polymarket, Robinhood, Interactive Brokers, DraftKings, FanDuel, BetMGM, etc., one concludes gambling already abounds. Create money everywhere, and people will bet on free throws in real-time. They’ll buy meme stocks and cryptocurrencies and gold.

One way to discourage gambling is to shift reliance for money from the Federal Reserve to people who deploy it and generate a return on it and loan it out. Real pooled money.

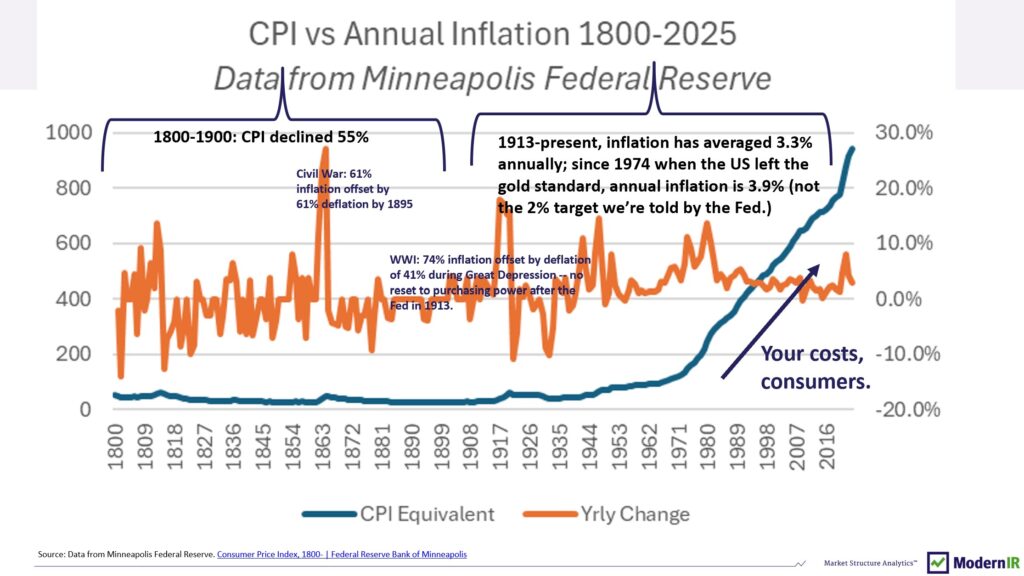

This graph BELOW reflects data from the Minneapolis Federal Reserve on inflation and the CPI equivalent. The Consumer Price Index was created by the Bureau of Labor Statistics in 1919, after WWI and the formation of the Federal Reserve in 1913 fostered astronomical inflation.

Before 1919, there was no government agency tracking inflation, and no inflation to track because prices showed a propensity to decline. The CPI from 1800-1900 fell 55%!

Look at the graph. I didn’t create the data. The Minneapolis Fed did. There is no Consumer Price Index unless there is INFLATION.

You follow?

So, what created “INFLATION?”

Answer: The government.

People forget that the guy behind government spending, John Maynard Keynes (from whence comes the modifier “Keynesian”), said:

By a continuing process of inflation, Governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth.

Keynes concluded, as the father of Bolshevism, Vladimir Lenin, had said, the best way to destroy Capitalism is to debauch the currency. Translating, through INFLATION.

What is Zohran Mamdani running on in New York? Affordability. What makes stuff unaffordable? Inflation. Who is responsible for inflation? The government. Specifically, the Federal Reserve.

Talking affordability resonates, and he’s right in the sense that affordability has gone missing on the fruited plain. But he’s looking in the wrong place – the cause – for a solution.

Here’s the Big Question. Is inflation better than what occurs naturally?

If the supply of money isn’t artificially enhanced by government printing presses, prices generally – central tendency – decline. Why? Things like industrialization, computerization, transportation arteries, artificial intelligence, etc., reduce the cost of making and acquiring stuff.

I like what I call the Baker Rifle Rule: In 1800, Ezekiel Baker sold flintlock rifles for about $100 apiece. State of the art then.

In 1894 you could buy a vastly superior weapon from Samuel Winchester, a repeating lever-action rifle, for about twenty-five bucks. How? Better technology, distribution.

How about a Ford Model T? You could buy one for the cost of a horse (about $250) in the 1920s. That’s purchasing power!

So why does a car cost $50,000 now? Why does a house – my grandparents bought one brand-new in Hastings Nebraska in the 1940s for $500 – cost $500,000?

I refer you to John Maynard Keynes. Our government has debauched our currency, and in the process, debauched capitalism.

There is nothing wrong with capitalism that can’t be fixed by getting government out of it. If you want your money to go further, cut out the middleman.

The reason education, healthcare, groceries, houses, cars, on it goes, cost so much isn’t capitalism. It’s too much money chasing our goods and services. Only government creates money, which then discourages savings, encourages spending – which inflates prices.

In the stock market, the Inflation Effect pervades. Risk assets soar (as do our model portfolios). We see it in patterns. But what always follows inflation is deflation. Which the government tries furiously to prevent – with more money.